December 15, 2025 Posted In

Quick Takeaways

- Adds Balance Beyond Stocks and Bonds: Private real estate’s income and appreciation drivers move differently from public markets, which may reduce overall volatility.

- Inflation-Linked Income Potential: Rents and replacement costs may rise with inflation, which may help protect real returns.

- Now More Accessible: Institutional-quality private real estate strategies are increasingly available to accredited and high-net-worth investors through fund platforms and managed offerings.

Why Now

With traditional stock and bond markets facing tighter yield spreads and ongoing inflation pressure, we believe many investors are rethinking how to diversify their portfolios. In our experience, private real estate, once limited to pensions, endowments, and family offices, is even more accessible through professionally managed private funds and sponsor direct platforms that make it easier to participate in high-quality, income-generating properties.

By providing exposure to tangible assets that produce income and appreciation, private real estate can help balance market volatility and deepen portfolio diversification.

Characteristics of private real estate

Private real estate involves investing directly or indirectly in physical assets such as multifamily housing, logistics, office, retail, or hospitality properties. Unlike publicly traded REITs or other products, these investments are held privately through limited partnerships, commingled funds, or fractional ownership structures.

Core features include:

- Illiquidity: Investments typically require multi-year holding periods.

- Valuation Lag: Appraised values change quarterly or annually, which may reduce short-term volatility but can delay recognition of market shifts.

- Income Generation: Properties can earn cash flow through lease payments made on time.

- Capital Appreciation: Value can rise through market growth, property upgrades, and for other reasons, but value can fall as well.

- Active Management: Execution quality – from leasing to financing – can materially impact returns.

How It Fits in a Diversified Portfolio

Private real estate behaves differently from stocks and bonds because its return sources – rental income, property appreciation, and inflation linkage – can respond to separate economic forces. That independence can improve risk-adjusted returns over time.

Key benefits may include:

- Diversification: Return drivers differ from those of equities and fixed income.

- Lease Income: Long-term leases can deliver recurring rent cash flow.

- Inflation Hedge: Property values and rents can rise with inflation and replacement costs.

- Risk/Return Profile: More balanced exposure to growth and income in certain markets.

- Low Correlation: Often moves independently from stocks and bonds, which can help smooth overall portfolio volatility.

Key risks include:

- Liquidity: Capital often locked for several years at least.

- Valuation Lag: Appraisals may not immediately reflect market moves.

- Leverage: Debt magnifies both gains and losses.

- Market Cycles: Tenant demand and property values fluctuate with local economies.

- Manager Selection: Experience, discipline, and transparency vary widely.

Because of these factors, private real estate is typically suited for long-term investors who can tolerate limited liquidity and prioritize income stability over quick gains.

How Individual Investors Can Participate

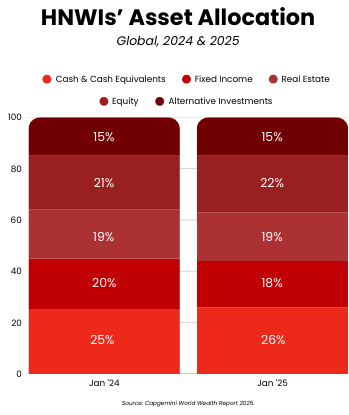

Some investors target 15-20%* of total portfolio exposure to private real estate, depending on their objectives and liquidity needs. Ways individual investors participate include:

- Private Real Estate Funds: Professionally managed portfolios offering diversification across multiple assets.

- Interval or Tender Offer Funds: Semi-liquid structures that allow periodic redemptions, bridging access and flexibility.

- Co-Investment and Fractional Platforms: Smaller minimums for direct property exposure without operational burdens.

These vehicles can allow individuals access to high-quality institutional real estate while benefiting from professional oversight and scale.

A Practical Framework

Investors often blend different real estate strategies based on goals and risk tolerance:

- Core/Core-Plus: Stabilized assets focused on income.

- Value-Add: Assets with repositioning or operational upside.

- Opportunistic: Higher risk/reward through development or specialty sectors such as logistics, data centers, or healthcare.

In our view, a well-structured allocation in commercial real estate diversifies across strategy, property type, geography, and position in the capital stack can help achieve optimal portfolio diversification across economic cycles.

The Bottom Line

We believe private real estate may complement traditional investments by including holdings that can support income, help mitigate inflation, and offer long-term value-creation potential.

But it’s not one-size-fits-all. These are long-term, illiquid investments best suited for investors with multiyear horizons and the ability to tolerate economic cycles. The key is aligning exposure size, structure, and manager quality with your broader financial plan.

Before investing, discuss private real estate allocations with a qualified financial advisor who can help you evaluate suitability, structure, and risk tolerance.

We do not make investment recommendations, and no communication, through this website or in any other medium, constitutes, or should be construed as, an offer, solicitation, or recommendation to buy or sell any security offered on or off this investment platform. Any offer or sale of securities will be made only through definitive offering materials, which contain critical information and risk factors. This website is intended solely for qualified investors. Certain statements may be forward-looking and involve risks and uncertainties, and actual results may differ. Investments in private offerings are speculative, illiquid, and may result in a complete loss of capital. Past performance is not indicative of future results. We do not provide investment, legal, tax, or accounting advice and do not act as a fiduciary to you. Prospective investors must conduct their own due diligence and are encouraged to consult with their own financial advisor, attorney, accountant, and any other professional that can help them understand and assess the risks associated with any investment opportunity.

Sources:

https://fundrise.com/education/real-estate-strategies

https://www.morganstanley.com/ideas/alternative-investments-portfolio-diversification

https://www.jpmorgan.com/insights/real-estate/real-estate-banking/institutional-real-estate-investing-how-it-works

https://origininvestments.com/real-estate-crowdfunding-is-really-property-syndicates-2-0/

https://www.ssga.com/us/en/individual/insights/building-resilience-with-private-cre

https://www.invesco.com/us/en/insights/private-real-estate-income-returns.html

https://www.hodesweill.com/real-estate-allocations-monitor

*https://www.capgemini.com/insights/research-library/world-wealth-report/